- Home EN

- News

- Latest news

- 2022

- Bouwinvest recorded double-digit total returns and growth of investor client base in 2021

Bouwinvest recorded double-digit total returns and growth of investor client base in 2021

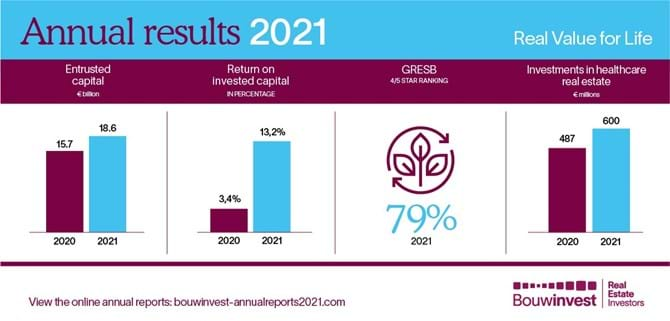

Bouwinvest Real Estate Investors generated a total return of 13.2% in 2021, despite the ongoing disruptions of the Covid pandemic. The growth of invested capital over the year also exceeded expectations, rising 17% to €15.7 billion, while the addition of 10 new investor clients to a total of 36 helped boost entrusted capital by 18% to €18.6 billion, well ahead of schedule.

Dick van Hal, CEO of Bouwinvest, said: “Despite these good results, we see a lot of worrying developments in the world. The Russian war in Ukraine is a tragedy, particularly for the Ukranian people. The images we have seen over the past months are horrific. This creates uncertainty and comes on top of the effects of the pandemic and the harsh reality spelled out in the latest IPCC report on climate change. It is still too early to speculate on the long-term effects of the conflict, but it will have a negative impact on business and economic activities in the region and globally for the foreseeable future.” As a residential landlord in the Netherlands, Bouwinvest has provided housing for Ukranian refugees in a number of municipalities.

In a response to the 2021 earnings, Van Hal said: "The principles Bouwinvest developed in March 2020 to deal with the negative effects of the pandemic proved to be very useful once again in 2021. Our strong results over the year stem from our sectoral focus on ‘beds and sheds,’ residential and logistics -- the winners of the pandemic within our diversified portfolio, and a resilient organisation and expanding global presence. Our international investments also made a solid recovery after generating lower returns in 2020.”

Bouwinvest made new investments of €903 million in 2021. All five Dutch sector funds obtained GRESB five-star ratings last year, the highest achievable score under the sustainability certification standard for real estate investment funds. This was the first time the five-star level was reached by both the healthcare and retail funds.

The Dutch funds invested €271 million last year in a number of investments around the Netherlands including primarily mid-market rental homes in The Hague, retail units on the Lijnbaan in Rotterdam, and homes for the elderly in Hillegom. For Bouwinvest’s European investment mandate, the company invested in affordable rental homes in Ireland and Germany and for the North American mandate in data centres, life sciences and logistics. In Asia-Pacific, logistics was on the target list in South Korea and housing for the disabled and data centres in Australia. Bouwinvest’s international investments now make up 31% of the total investment portfolio (2020: 26%).

Dick van Hal added: “Real estate remains a growth market. There is particularly strong global demand for the residential, logistics and healthcare sectors and this will require considerable capital, which institutional investors can make available. We will build on our strong presence in our home

market in the Netherlands, but we are also becoming increasingly active internationally to achieve a healthy diversification of investments within the portfolio. And we believe in our purpose real value for life: finding the right balance between financial and social returns is the only way to guarantee our success going forward.”

All of Bouwinvest’s Dutch assets and 34% of its investments in international real estate are classified as sustainable by GRESB as of 31 December 2021. This is in line with the company’s targets for its home market and well above the current goal of 29% for its international portfolio. Bouwinvest is also on track to reduce carbon emissions to net zero by 2045 as part of its bid to meet the ‘Paris Climate Accords’ target, five years earlier than stipulated. Bouwinvest expects to increase invested capital to €16.4 billion in 2022 and is targeting above-average sustainability ratings (GRESB 4 or 5 stars) for at least 80% of its invested capital.

The annual reports of the Bouwinvest investment management organisation and its Dutch open-ended funds are available online at: https://www.bouwinvest-annualreports2021.com/.