- Home EN

- Investments

- Impact Partnership

Social Impact Partnership

At a time when the Dutch (care-related) housing market is totally out of balance, the Dutch Social Impact Real Estate Partnership is aiming to realise and preserve affordable rental homes. Bouwinvest is doing this together with two major Dutch pension funds, ABP and bpfBOUW. Our common goal: homes in the social and lower mid-rental segment for those who are currently falling between the cracks in the housing market.

Given the structural shortage of suitable and affordable housing in the Netherlands, we are focusing on the realisation of rental homes in the social and lower mid-rental segment. These homes are meant for low and middle-income earners, and for people in key professions, such as police officers and healthcare workers. These are precisely the people struggling to find a place in our big cities.

Impact investing to fill the gaps

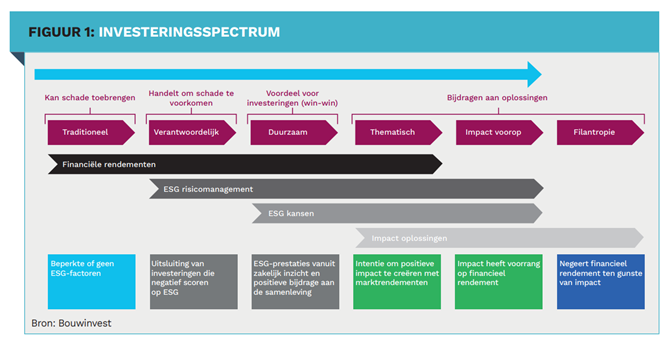

Impact investing in real estate offers us an opportunity to fill the gaps left by traditional investors and housing corporations. Our priority is to add something positive to society and in doing so, we also provide investors with modest but healthy returns with a low risk. Or, as The Global Impact Investing Network (GIIN) puts it: “Impact investments are investments made with the intention to generate positive, measurable social and environmental impact alongside a financial return”.

Our approach to impact investing is reflected in three strategic pillars: affordable, appropriate and healthy. These are at the heart of our strategy to invest not just in bricks and mortar, but rather in people and communities. This approach will enable us to achieve significant and measurable social impact, which goes hand in hand with solid financial returns for our investors.

Affordable

We are committed to creating homes that are not only affordable at the outset, but also remain affordable in the long term. By investing in energy-efficient (care-related) homes with a social or mid-segment rent, we aim to ensure a realistic financial cost for our tenants. Our aim is to have a positive impact on our tenants, by making and keeping homes available that are a good financial fit with our tenants’ incomes.

Appropriate

Appropriate housing is more than just a roof over one’s head. It is also about finding a home that suits particular phase in a residents’ life and how they want to live. We focus on providing homes that are tailored to the specific needs of various target groups in terms of size, type and available amenities. From young working people to seniors, from small to larger households, and those in need of care; our partnership is committed to a housing market that welcomes everyone.

Healthy

The quality of our living environment has a direct impact on our health and well-being. This partnership is very much committed to the realisation of housing and care-related properties with healthy indoor environments. After all, healthy indoor environments contribute to the physical and mental well-being of our tenants. We also invest in social properties that enhance social cohesion and a sense of community, with spaces that invite meetings, participation and education.

News

Bouwinvest raises €520 million in new commitments and executes €503 million in real estate transactions in the Netherlands in 2023

BpfBOUW, ABP and Bouwinvest join forces in Impact Partnership: € 400 million for affordable homes

GRESB 2023 benchmark survey results: Bouwinvest records high sustainability scores

We are keen to get in touch with you

Do you have ideas for generating social impact? If so, we would very much like to get in touch with you. Please contact: