- Home EN

- News

- Latest news

- 2019

- Bouwinvest has emerged stronger from challenging period with supervisory board

Bouwinvest has emerged stronger from challenging period with supervisory board

Dutch real estate investor Bouwinvest has regrouped since the resignation of its supervisory board at the end of 2018. “That put some pressure on the organisation, but it’s all behind us now,” Dick van Hal, Bouwinvest’s CEO said in an interview with Dutch real estate magazine Vastgoedmarkt. “We are now looking forward to our next move. We have a new strong supervisory board and have found a good CFRO (chief financial and risk officer) in Rianne Vedder, who will also be our second statutory director. In addition, we have expanded our team with 20 new recruits, but we are still looking for a director of client management.”

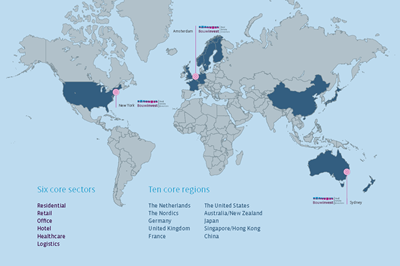

Turning to Bouwinvest’s growth strategy for the coming years, Van Hal points out that Bouwinvest has existed since 1952 and has evolved from a ‘bricks-and-mortar’ department closely linked to the Dutch construction workers pension fund bpfBOUW, with its own development unit and a portfolio focused exclusively on Dutch real estate, into an independent, sustainable investment manager operating at arm’s length from its parent investor and active in 10 countries globally on behalf of some 25 institutional investors. “We opened an office in Sydney this year and have finalised all the procedures to open an office in New York in early 2020. The total size of the portfolio currently amounts to some €12.5 billion, excluding a pipeline of more than €2 billion, and we aim to grow the portfolio by at least €1 billion every year.”

Diversification strategy

As Bouwinvest evolves, it is becoming more flexible, Van Hal said. “So much is changing around us due to wide-ranging developments such as urbanisation, globalisation, climate change and digitalisation. Geographic diversification is vital,” he added. “A year ago, we weren’t thinking at all about what’s going on now in Hong Kong. And, with regard to our Dutch portfolio, we didn’t have any idea yet about the discussion currently taking place in the Netherlands about nitrogen emissions and the problems with PFAS chemicals and that it would have such an impact on the building sector and real estate. The dynamics of what’s going on around us require us to adapt our organisation so that it can cope with unexpected developments.”

Bouwinvest’s investment strategy focuses on a specific group of countries and regions, but the Netherlands remains the dominant country in the portfolio. “Since we don’t invest in high-risk strategies, that restricts the countries we want to be active in. We now invest in 10 countries and core regions, including the Netherlands, North America, Scandinavia, Germany, the United Kingdom, France, Australia/New Zealand, Japan, Singapore/Hong Kong and China. These are all transparent real estate markets with quite some liquidity.” In addition to global diversification, Bouwinvest also focuses on sector diversification. “We are active in six sectors: residential, retail, offices, hotels, healthcare and logistics. We invest in all those sectors wherever we are active,” Van Hal concluded.

Read the full interview (in Dutch) here.