- Home EN

- News

- Latest news

- 2018

- Improved GRESB sustainability ratings for Bouwinvest’s Dutch sector funds

Improved GRESB sustainability ratings for Bouwinvest’s Dutch sector funds

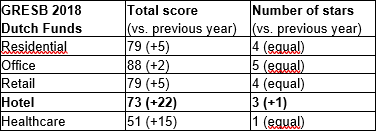

All Bouwinvest’s Dutch property sector funds saw improvements in their scores in this year’s Global Real Estate Sustainability Benchmark (GRESB) rankings, the ESG Benchmark for real assets, compared with 2017. The Dutch funds in residential, office and retail, maintained their scores at the top-end of GRESB’s five stars grading system.

Dick van Hal, CEO at Bouwinvest, said: “Bouwinvest is very proud that our largest Dutch investment funds have kept their ‘Green Star’ awards, as is the case for the Five-Star office and Four-Star retail and Four-star residential portfolios. Our ‘Green Team’ will assess how we can improve the Environmental, Social and Governance performance of the other funds to also bring them into the upper categories in the future.”

On a relative basis, the smaller Hotel and Healthcare funds saw the largest increases in points scored, with the hotel portfolio rising to Three Stars from a Two-Star grading previously. The Hotel Fund is Real Estate Sector Leader in the Peer Group of European Hotels.

GRESB is the global environmental, social and governance (ESG) benchmark for real assets. Working in collaboration with the industry, GRESB defines the standard for sustainability performance in real assets, providing standardized and validated ESG data to more than 70 institutional investors. In 2018 a record 874 property companies and funds participated in the GRESB Real Estate Assessment. Bouwinvest participates in GRESB since 2013.