- Home EN

- News

- Latest news

- 2020

- Bouwinvest posts robust 2019 results on eve of Covid-19 Crisis

Bouwinvest posts robust 2019 results on eve of Covid-19 Crisis

Bouwinvest Real Estate Investors expects the impact of the coronavirus pandemic to differ significantly across its suite of funds according to property sector in 2020. The company’s research team has drawn up three market scenarios, ranging from optimistic to realistic and pessimistic, and the expected impact varies from ‘limited’ for its largest Dutch Residential Fund, to ‘severe’ for its Dutch Hotel Fund which accounts for a relatively small share of the total portfolio. Bouwinvest is starting from a good base, however, following a solid performance in 2019, when it achieved a double-digit investment return for the fifth time in a row over its total business, including the Dutch and international activities.

Dick van Hal, Bouwinvest CEO, said: “The outbreak of the Covid-19 virus has plunged the world into a crisis and national governments everywhere are taking measures to contain the pandemic. Clearly, this crisis has severe implications for the global and Dutch economy as well as each of the real estate sectors in which we are active. But we need to distinguish between the short- and long-term repercussions. In recent weeks, we have, for example, been holding intensive discussions with the tenants and residents of our buildings on how we can help those who have been affected financially. This is a logical thing to for us to do. After all, our long-term goals go hand in hand with long-term relationships with our tenants. We will strive to be as flexible as possible in our dealings with those who are experiencing payment difficulties. The expected impact on returns in the various real estate sectors in which we are active differs significantly, but for the medium to longer term we are optimistic. The fundamentals of our business remain strong.”

For April of this year, the manager has deferred rental payments for tenants who have indicated they are experiencing, or expect to experience, financial problems, for all its funds. It is now looking for tailor-made solutions for tenants who continue to have difficulties paying their (full) rents after this month. Overall, Bouwinvest expects all its Dutch sector funds will generate slightly negative investment returns in 2020.

Bouwinvest posts strong societal returns as well; Dutch Hotel Fund is GRESB’s Global Sector Leader

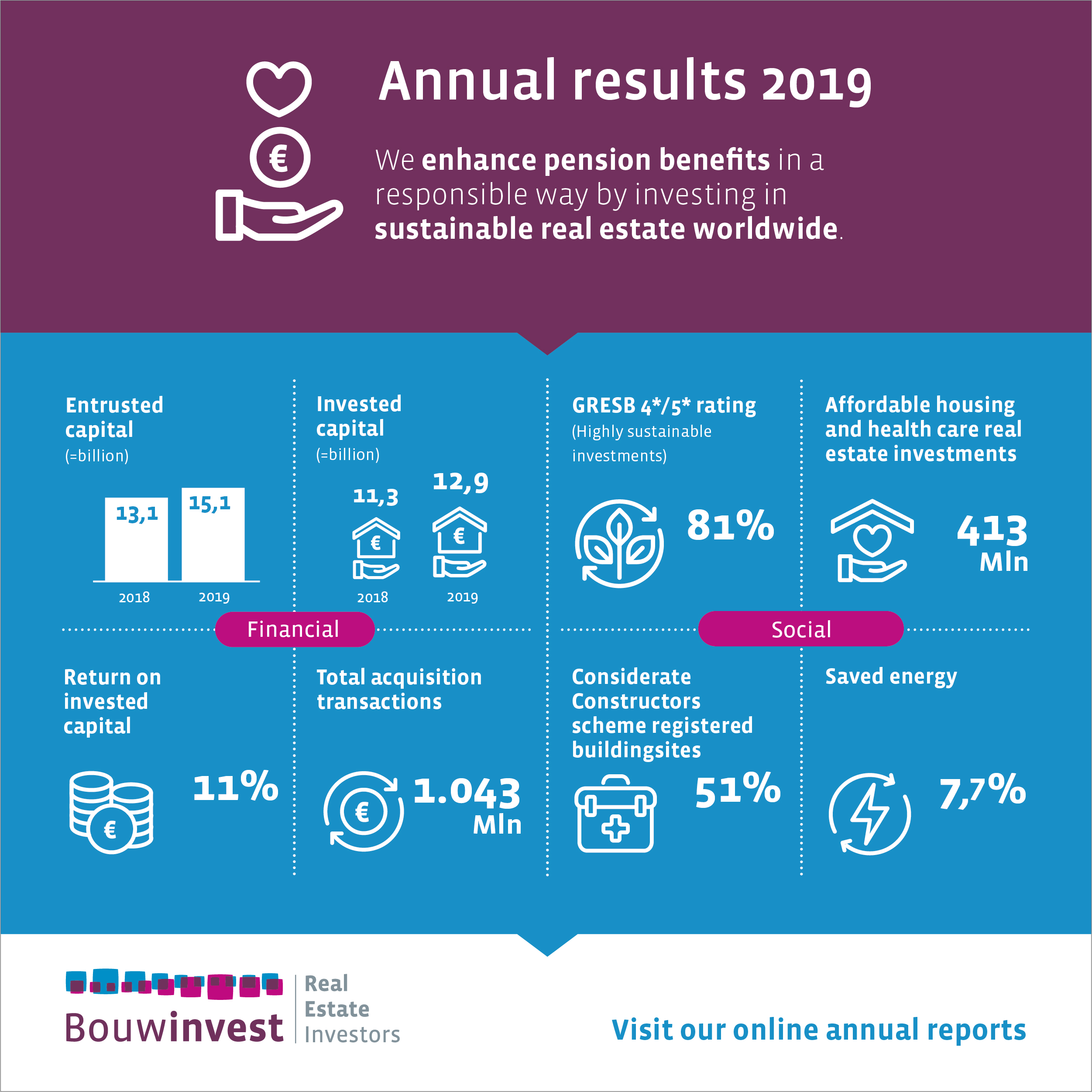

Van Hal added he was proud of Bouwinvest’s strong earnings performance in 2019, which provide a sound foundation for the company to build on, in both financial and societal terms. More than 80% of the company’s invested capital now qualifies as sustainable with a four- or a five-star score under GRESB (Global Real Estate Sustainability Benchmark).

As part of its mission to create societal as well as financial returns, Bouwinvest is expanding its portfolio of healthcare real estate and rental increases for residential units will be capped. In 2019, Bouwinvest has spent at least €413 million on healthcare properties and affordable housing. The company also invests in sustainable real estate and greening its existing portfolio. Partly as a result, our Dutch portfolio booked an overall 7.7% decline in energy consumption. The goal is to create healthy, safe and inclusive urban areas where people want to live, work and spend their leisure time, now and in the future. By investing in this type of property, Bouwinvest creates value and generates long-term stable returns for its clients, pension funds and insurers.

1 billion of acquisition of which almost half international

For the full-year 2019, Bouwinvest posted a total investment return of 11% over its portfolio, well above its target of 8.4%, but slightly down on the record level of 12.4% realised in both 2018 and 2017. The strong result was largely due to double-digit capital value increases at three of its Dutch core unleveraged Funds, including Offices, Hotels and Residential, as well as the North America and Asia-Pacific mandates.

Bouwinvest saw its invested capital rise 14% in 2019 to €12.9 billion, from €11.3 billion the previous year, thanks partly to the robust growth of its Dutch Office Fund (+ 39%) and its Residential Fund (+13%), as well as the steady expansion of the three international regional mandates - Europe (ex-Netherlands), North America and Asia-Pacific.

Van Hal said: “Our return on invested capital in 2019 marked the fifth year in a row that we have reported a double-digit return and we also outperformed with regard to our sustainability targets. We continue to expand our international portfolio and, after opening our first international office in Sydney in 2019, are gearing up to launch our office in New York in coming months.”

In 2019, the manager closed just over €1 billion of investment deals split virtually equally between its Dutch sector funds and global mandates. The international transactions included logistics centres in Australia, affordable rental homes in the U.S., China, France and Japan, and offices in Northern Europe and leading Asian cities.

The Dutch sector funds also had a good year with acquisitions totalling €540 million. Purchases included mid-market residential properties in Delft, Ede, Haarlem, Zwolle and Eindhoven and healthcare assets in Heerenveen, Harderwijk and Zoetermeer. In the office sector, The Olympic Amsterdam was delivered in the second half of the year and in the retail portfolio the redevelopment of the Goverwelle and Muntpassage shopping centres in Gouda and Weert were completed. Altogether, the development pipeline increased to €1.9 billion.

Entrusted capital totals €15 billion

The Europe, North America and Asia-Pacific Mandates currently account for €3.6 billion in invested capital and the manager has another €1.4 billion in entrusted capital for new investments for these mandates. The company continued to broaden its investment base in 2019 and at end-December had capital commitments from 25 pension funds and insurers totalling €15.1 billion.